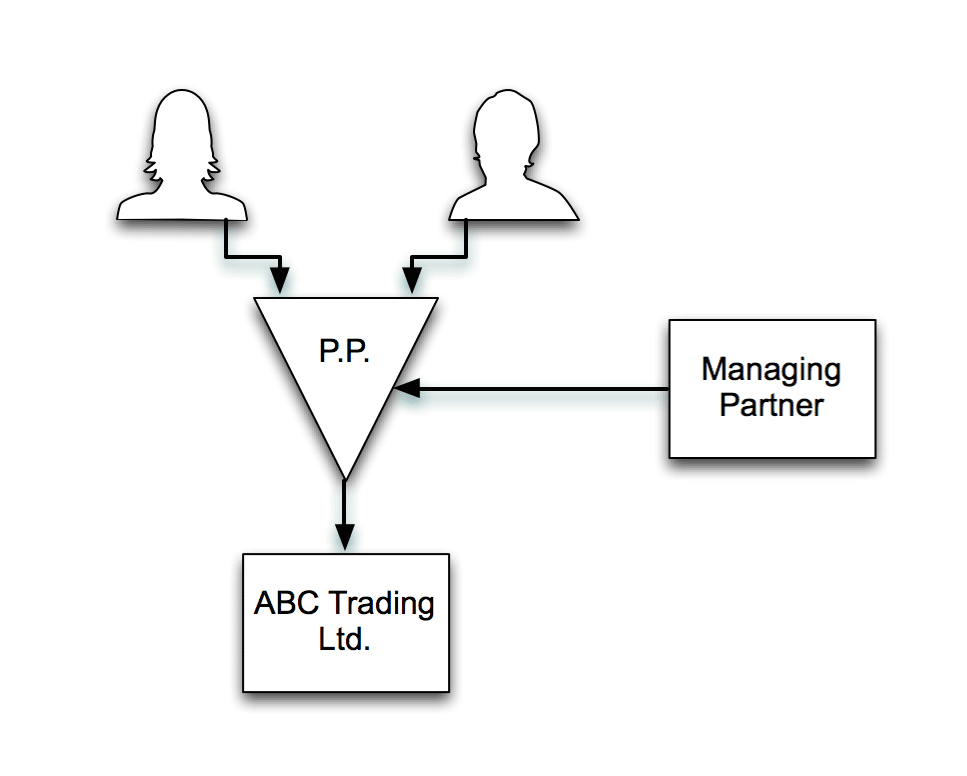

One or more silent partners (as limited partners) establish a private partnership, together with a managing partner as a general partner. The silent partners have no part in the management and apart from their deposit they carry no risk. The managing partner bears the risk and conducts the business. This is usually a limited company.

The role of the managing partner is usually taken by a lawyer who is trusted by the partners. The profits of the partnership are contractually agreed so that the partners get paid according to their holdings, and the function of the managing partner is remunerated by a fixed amount.

The private partnership is often used for a holding function. For a private partnership to be tax effective, it is important to have not only a furnished office but also an own business in Cyprus, such as employee leasing, subletting or consultancy (if appropriate personnel are employed). The gains from the private partnership’s own activity and its interest income are taxable in Cyprus on the basis of income-tax. Other income such as dividends or capital gains (due to share value appreciation) is tax free in Cyprus.

Royce Office can provide you with the necessary basis for this, by offering you a permanent establishment. Our experts can also advise you about how to go about building your company’s own activity.

Cyprus Private Partnership for Austrians

For Austrians, the Cypriot-Austrian double taxation agreement offers special advantages: it deviates from the OECD standard text by specifically ruling that the profits of a private partnership are to be taxed in Cyprus. This also applies to dividend income, provided that the private partnership maintains a normal and compliant office operation and carries on its own activity, which should be related to the subsidiary. Given that Cyprus demands no tax for dividends, and given that Austria has no right to tax such income, these profits remain tax-free.